-

In Case You Missed It: Best of Summer 2024

The article highlights the five most popular newsletter topics as summer ends, focusing on employee benefits, retirement planning, job searching, remote work culture, and the use of AI for lead research. These insights aim to help readers enhance their professional and personal lives, with more content expected in the fall.

-

ETFs vs. Mutual Funds: Understanding the Key Differences

Exchange-traded funds (ETFs) and mutual funds are popular investment choices for achieving financial goals. Both offer diversification and professional management, with key differences in trading, fees, transparency, tax efficiency, and minimum investment. Choosing between them depends on individual circumstances, preferences, and investment goals. ETFs may be suitable for lower costs and tax efficiency, while mutual…

-

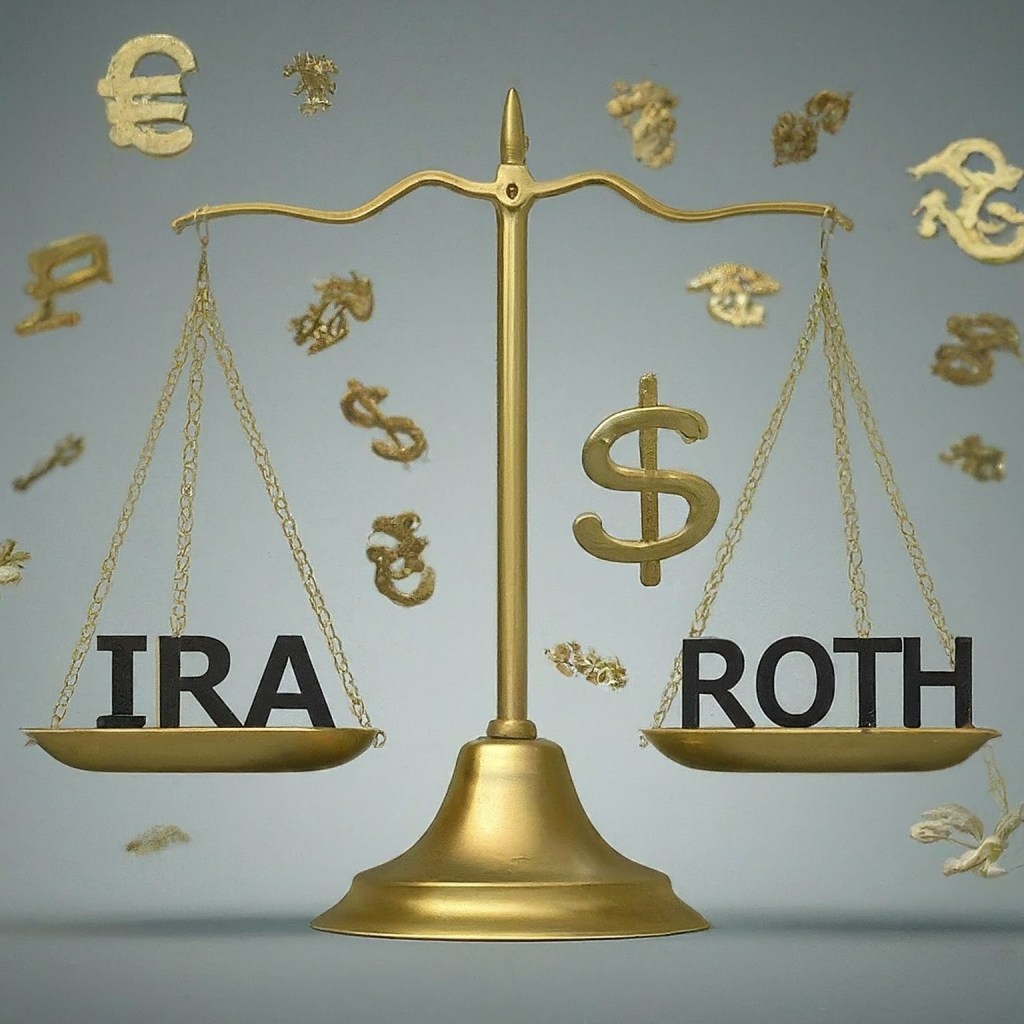

Beyond Roth: Comparisons to a Traditional IRA & Backdoor Conversions

The Roth IRA offers tax-free retirement savings, while the Traditional IRA allows tax-deductible contributions and tax-deferred growth. The choice between them depends on factors like current and future tax rates. For high earners, the “Backdoor Roth” conversion strategy can provide tax-free retirement income, but careful consideration and professional advice are crucial.

-

In Case You Missed It: 4th of July Best Hits Edition

As we prepare for the 4th of July, we’re highlighting our top 5 newsletter articles covering business operations and personal life tips. Explore topics like dealing with sales taxes, project management tools, Health Savings Accounts, personal mentorship, and handling adverse business prospects. Enjoy the holiday and we’ll be back next week.

-

Roth IRA: Your Retirement Cornerstone

Roth IRAs offer tax-free growth and withdrawals, flexibility, and long-term retirement accumulation. Contributions are made with after-tax dollars, allowing for tax-free growth and withdrawals. Early-career starters benefit from locking in lower tax rates. Other advantages include flexibility, no required minimum distributions, and protection against future tax increases. Eligibility and contribution guidelines apply, and various strategies…

-

What’s an HSA?

A Health Savings Account, known as an HSA, is an underutilized savings account that has some versatile tax benefits you may want to consider. Its purpose is to help you save & pay for qualified medical expenses, including medical, dental, vision, and prescriptions. These plans are great options for those with high-deductible health plans (more…

-

How should I Incorporate my Business?

Are you looking to start a business? Do you know how you legally want to structure your business? There are three main categories that identify how you should decide to structure your business: number of owners, who’s liable, and who pays taxes. See a breakdown below of the different types of business structures possible for…

-

Sales Tax & Rainy Day Funds

Startup Ops Tip #1 | Sales tax, don’t wait until it’s too late. The cost of doing business includes sales taxes. It’s not the most exciting part of startups & small businesses, but it’s crucial. Most SaaS products & tangible goods will be taxed on the state level. Research each state’s sales tax requirements and consult…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.