As a new founder, surrounding yourself with experienced individuals is crucial for success. This network can include investors, key hires, mentors, and advisors. Advisors, specifically, offer deep technical expertise to guide you through the challenges of building a company. They provide valuable insights, connections, and an objective perspective, all focused on the company’s growth and success. In return for their expertise and commitment, advisors typically receive compensation. The most common form is equity in the company, which vests (becomes fully owned) over a period of 2-3 years.

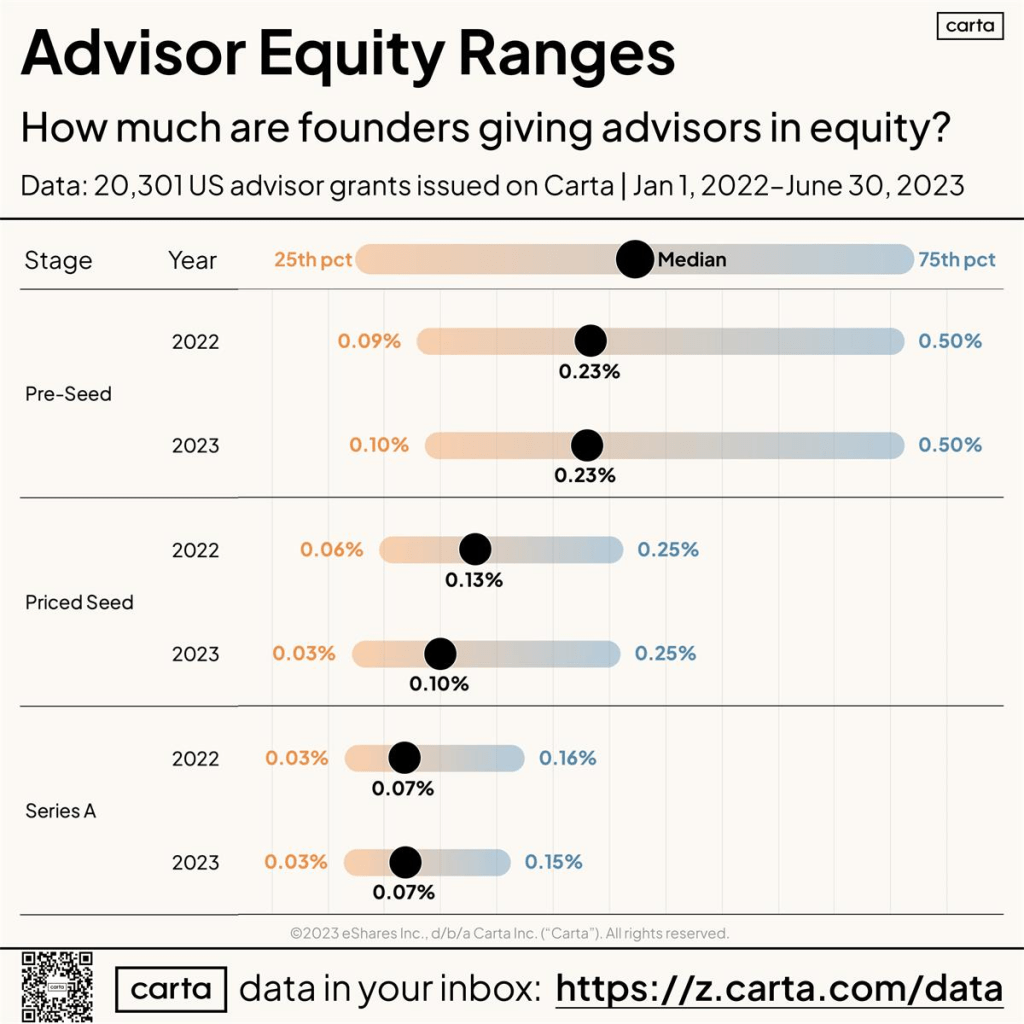

Deciding how much equity to offer an advisor can be challenging. Carta has provided valuable data points to help you benchmark appropriate percentages:

There is also more information on advisory shares here as well (see link to Carta). I would recommend using this as a good resource for advisory questions.

Today, though, I offer another option to help gut check yourself and the percentage, especially if you prefer a by-the-numbers approach. I came across this article on Medium about Travis Kalanick & his method of calculating advisory equity. Over the years I built a calculator to complement this calculation.

Asterops Advisory Equity Calculator (Google Sheets)

The yellow cells are adjustable based on your use case so feel free to make a copy & try it out. There is a section I also added where the equity can be blended with an hourly or monthly retainer rate as well. I have used the calculator a few times with startups & found some prefer a mixed equity & hourly rate structure based on their own financial modeling.

Check it out, give it a try, and send over any feedback you have as well.

– M

Leave a comment